Financial Services

our services

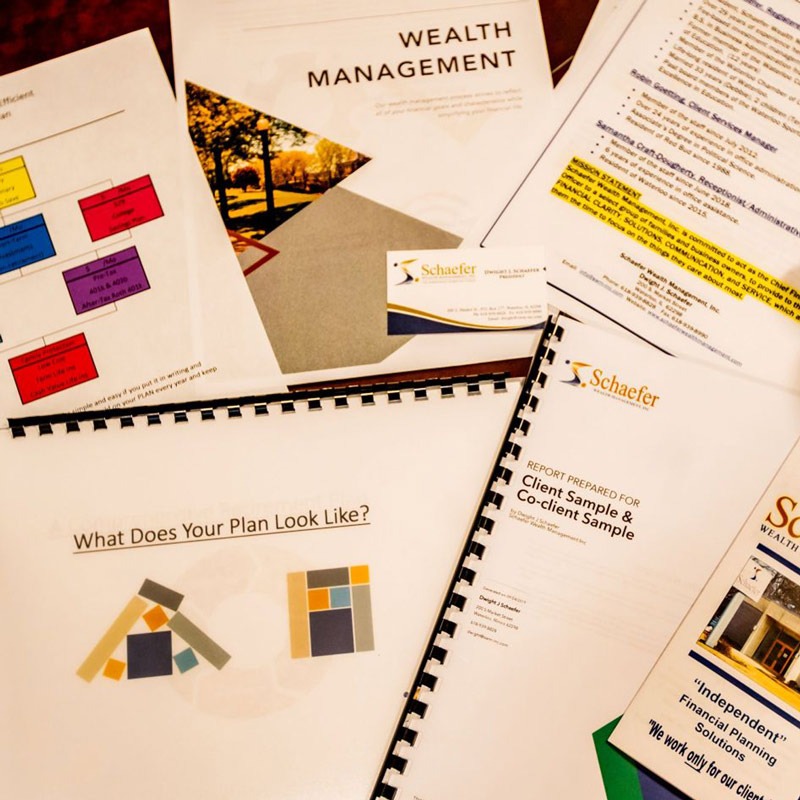

Wealth Management

Retirement Income Planning

Efficient Tax Planning

Maximizing Social Security

Wealth Management

Wealth management takes a holistic view of your portfolio, making changes to nearly every part of your holdings so you can maximize your assets. Unlike other services that take a microscope to one section, like your stocks or your securities, wealth management is a popular way for wealthy people to maintain control over their sizable assets.

Why Try Wealth Management?

In most households, wealth management boils down to keeping track of your finances, trying to spend less whenever possible, and staying open to investment opportunities as they present themselves. In the wealthiest households, though, it’s easy for wealth to extend to nearly every industry sector. From real estate to bonds to commodities, keeping up with your wealth can become a full-time job in and of itself.

This is why it can help to contact a financial advisor in the St. Louis metro area. A financial advisor can keep track of your portfolio, showing you where you can make changes and explaining to you what benefits you can expect to see. Moreover, they can keep up with even the most fickle markets, giving you the notice you need to sell or buy before it becomes a blight on your portfolio.

If you've ever forgotten that you own an asset, whether it's in the market or in your basement, it's not hard to see why wealth management can be a valuable service for many people. The more you stay on top of your wealth, the less likely you are to lose it.

At Schaefer Wealth Management Inc., we know that it can take an inordinate amount of time and expertise to maximize a retiree's monthly income. It's why we factor in everything from asset strategies to investments to real estate. As with any financial service, we believe that diversifying is the best way to reap the strongest rewards. If your portfolio has been gathering dust for longer than you care to admit, wealth management is the perfect way to infuse life into it — and bring it back into the limelight.

Retirement Income Planning

When most people think about their retirement income, they probably think about their savings. If they’re very lucky, they might think about a generous Social Security check and an equally generous pension.

No matter who you are, where you worked or how many assets you have, though, most financial advisors agree that you need an income planning strategy. If you’re looking for the best way to approach your retirement, partnering with the right professional may get you further along than you think.

What Is Retirement Income Planning?

Retirement income planning refers to securing as many revenue streams as possible during your golden years. So, instead of having to tap into your savings account every time something goes wrong, you can rely on rental income, government benefits, part-time job income, stock dividends, etc. If you’re wondering which revenue paths are right for you, a financial advisor can show you how to set everything up and how much you can expect from each source.

How much do I need to retire? In the St. Louis metro area, it comes down to how you plan to spend your time. People who grow or raise their own food won't need as much as someone who can't get enough Michelin-starred restaurants. The commonality between all retirees, though, is that eventually you'll run into unplanned expenses that you won't want to deplete your holdings for.

A financial advisor like Dwight Schaefer at Schaefer Wealth Management can help you work out difficult questions before you reach your retirement age, showing you how to plan your retirement income according to the way that you want to live your life. This way, you won't have to wait until you buy a property to discover that you don't want to devote time to being a landlord. Or you'll discover that you can make a supplemental income doing something you've always wanted to do, like teaching piano to kids or pouring wine surrounded by vineyards. No matter how you picture your lifestyle, the right partner can help you get there.

Efficient Tax Planning

When confronted with tax laws, policies, and code adjustments, most people feel comfortable asking for help with tax planning. Maybe you Google a few questions before filling out an EZ form, maybe you ask a co-worker or friend, or maybe you go straight to a CPA to get everything right.

While all of these actions can help you understand your taxes better (and potentially pay less in the short run), you may be missing out on a much bigger piece of the picture. When you work with a financial advisor, you can start to see how your taxes fit in with your ideal retirement landscape — and why it’s so important to file based on your long-term goals.

How Does Efficient Tax Planning Work?

Efficient tax planning in the St. Louis metro area is the art of filing your taxes based on current laws, desired portfolio, and personal preferences. If you’re wondering how a CPA differs from a financial advisor, the answer comes down to exposure. With a CPA, you might only work with them for a week or two out of the year. While they might have a general idea of how your taxes impact your daily life, they won’t be able to advise you the way a financial partner will. From Social Security to pensions to annuities, you can get a sense of how to keep up with your obligations without sacrificing your holdings.

At Schaefer Wealth Management, you’ll work with a team that takes the time to see how your taxes impact your assets, and how they’re helping (or, in some cases, hurting) your dreams. For example, maybe you’re hoping to buy several properties before you retire, but your capital gain rights on other sales are impeding the purchases. A financial advisor can help you navigate a 1031 exchange, so you can roll your profits into an equally lucrative investment. What’s more, you can work with them over the course of several years, giving them unparalleled insight into how to leverage state, local, and national tax codes to your advantage.

Maximizing Social Security

Social Security has a patchy reputation in many parts of the US, especially in areas where the cost of healthcare and basic living expenses continues to rise. Unfortunately, this reputation can lead people to underestimate this program as a source of income — especially if they personally know someone who receives a mere pittance for their many years of hard work.

However, while no financial advisor would tell a client to rely solely on their Social Security income to pay for their lifestyle, it’s always worth exploring as one of several viable income streams. If you’re wondering how to bulk up your monthly income during your retirement years, an advisor can help you get everything you’re owed out of the system.

How to Maximize Social Security

The best way to maximize Social Security is to first understand how the program works, but thanks to the endless iterations of the policy over the last nine decades, this is no easy task. People often fail to understand that the range of benefit checks can be substantial. While the average is just a hair over $2,000 per month, it’s important to keep in mind that the maximum can go over $5,000 per month. In other words, if you settle for less than what you’re owed, you can end up leaving more than you think on the table.

At Schaefer Wealth Management, you’ll meet Dwight Schaefer, a professional who understands how to file your paperwork, so you can be confident in the final total. If you file on your own and make an error along the way, it can take months or even years to right the wrong with the federal government (and even longer to get the backpay you’re due).

Maximizing Social Security takes some specialized knowledge that a general online estimator can’t provide. The best part is that when you work with a financial advisor, you can work with them to determine how much additional income you’ll need to maintain your lifestyle — and where exactly to find it.